Calling All

Real Estate Professionals!

Want to legally earn commissions on the mortgage loans associated with your transactions... without getting an individual state mortgage license and without having to learn loan production?

What is a DUAL Commissions Agent?

A Real Estate Agent who is also a Mortgage Loan Officer

Exclusively for select top-producing agents

Gives you the ability to offer purchase and refinance lending services to your clients in ALL 50 STATES without needing to get your own individual state mortgage license!

“White Glove” Concierge team handles the loan production process for you from application to close

Allows you to earn a commission for your buyer clients who choose to work with you

What does a DUAL Commissions Agent do?

Perhaps the better question is:

“What does a Dual Commission

Agent NOT do or not HAVE TO do?

Reviewing this chart you'll find by clicking this orange button, we’ve been able to remove the onerous tasks that normally make Real Estate professionals think twice about becoming a loan officer.

On the “right” side, taking the app used to mean completing a paper application at the clients' dining table, now it is simply conveying your link to them. Once that is started, your team can help from there, making sure that it is completed properly.

The other green tasks should look familiar as the RE Agent is already doing them.

Download the calculator (View video for help)

Keep in mind that this calculator simply creates estimates

based on your input.

The Cost of NOT Being a DUAL Commissions Agent

How much money are YOU losing each month by NOT being a DUAL Commissions Agent? You might be thinking “That’s crazy! I’m not losing money.” Really? What do you think is happening every time you GIVE AWAY amortgage loan to an outside Loan Officer? (Not hatin’, just statin’ 😂)

Download the calculator (View video for help)

Keep in mind that this calculator simply creates estimates based on your input.

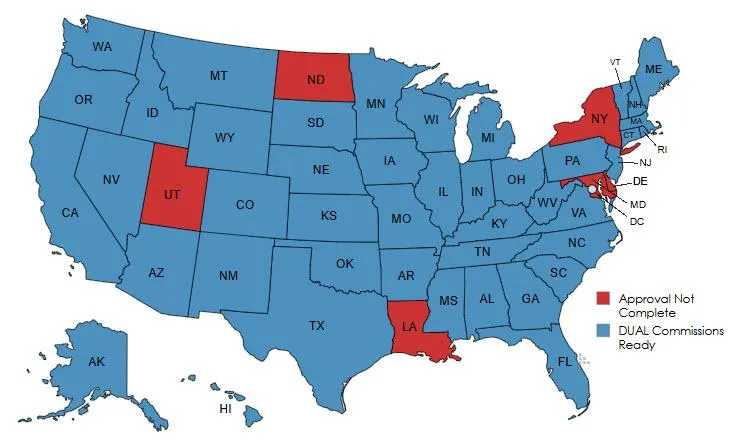

DUAL Commissions Map

* In the RED states, you may currently act as either a Realtor or a Loan Officer but not as both on the same transaction

Testimonials

Rex Andrews

____________________________________________________

I earned $2,209.24* in addition to my real estate commissions on my very first closing. Once I introduced my first client, the whole process was seamless. The Loan Concierge team handled everything and my Loan Partner was amazing. My clients LOVED her!

Cindy Anderson

____________________________________________________

I didn’t know how it worked or how much effort it would take to refer my clients. But I’m so glad I gave it a shot! It’s like having an extra team working for me without any extra effort. And the best part? We earned a commission of $2,111* on the loan in addition to the real estate commission.

Scott Hudspeth

____________________________________________________

The additional income from mortgage commissions has been a game-changer for my business. I have been able to provide a more comprehensive service to my clients, which has boosted their satisfaction and led to more referrals. The whole process has been easy and stress-free.

* There is no guarantee of any earnings. This number is based on fixed basis point on the loan amount. You may earn more or less depending on your loan amounts.

Frequently Asked Questions

How does this work?

Easy. As a Real Estate professional, you become a loan officer for our federally charted bank. Instead of referring your clients who need financing to an outside loan officer, “you” do the loan by introducing your client to your inside loan partner and get paid for it. This additional revenue can significantly boost your income.

Are you nuts? There’s no way I’m jumping those hoops to get a license.

You don’t have to. Because the rules are different for federally chartered banks than they are for other lending institutions, you don’t need to get or maintain an individual state lending license. The law states that loan officers who are the W2 employees of federally chartered institutions may originate loans under the license of the institution, and since it is a federal license, they may originate loans in all 50 states.

Wait! I’d be the Agent and LO on the same transaction?? Isn’t that a conflict of interest?

Actually, it’s not. It was only ever considered a conflict by HUD and only for FHA loans. But that changed in December of 2022 when HUD updated its “conflict” definition to exclude loan officers. Now, except for USDA, it’s no longer considered a conflict by any federal governing body or organization. Note: There is a disclosure sent with the initial disclosure package that lets the client know that you’ll get paid on both sides of the table and that they are not required to use you as the LO if they have a different preference. View the HUD Conflict of Interest Update Memo here.

No thanks. I’ve already got a job! 😂

That’s the beauty of the Dual Commissions (DC) program. With your “White Glove” loan concierge team, you don’t need to learn the loan production process. Your team will handle the loan from receiving the application all the way to closing. Your job description really doesn’t change. Right now, you refer your buyer to a loan officer and they handle the process. With DC, you’ll simply text or email your application link, refer them to your (inside) loan partner and your loan team will handle the process. It will work the same except with DC, you’ll get paid. 🎯👍 Of course, there are normal Agent tasks to complete, i.e., shopping for houses, uploading an executed contract, communicating with the client, and scheduling the closing.

So then...how much WILL I get paid?

DUAL Commissions Agents receive a payout of 50 basis points. For easy math, that’s $5,000 for each $1 Million in loan volume. Of course, it’s paid on whatever the actual loan amount is, so a $500,000 loan would be $2,500 and a $200,000 loan would be $1,000, etc. If you fund more than $1 Million in a calendar month, you’ll recieve an additional 10 bps on the entire volume. Also, you will be paid as a W2 employee because the rules that allow this program to work only apply to W2 employees. If you haven’t done so, download the Dual Commissions Stop Losing Money Calculator to run some different scenarios.

Would I need to move to a different RE Broker?

Absolutely not! You may be a DUAL Comissions Agent with any broker you choose. Your choice of broker has no bearing on your standing as an employee with the bank.

Would my loan commissions come through my RE Broker like my other commissions?

No. You will receive fully compliant W2 commssions directly from the bank because you would be a W2 employee of the bank.

What loan programs can I offer?

As mentioned earlier, in addition to their own programs, the bank has either Correspondent Lending or Broker relationships with more than 100 other lending sources. If each had only 20 program (this is a low estimate) that means that you will have over 2,000 programs at your disposal, covering virtually any lending need including but not limited to Conventional, FHA VA, First Time Homebuyer, Down Payment Assistance, DSCR, ITIN, Lot Loans, Land Loans, Construction (including one time close), Reverse, 2nds, Fix ‘n Flip, Non-QM, Commercial, etc.

Will my rates be out of the market or will I be competitive?

You will have broker pricing so yes, you will be extremely competitive

What if my client somehow wants/needs a program I don’t have?

That would be unusual but if they have found a program that we can’t get, they are always free to use that program with whomever is offering it. Remember, we can’t compel them to use us. They are free to choose whomever they would like.

Will my current E&O insurance cover this or will I need to get a different policy?

Neither. You will be covered by the bank’s E&O policy because you’ll be an employee. This won’t affect your current policy and you won’t need to buy a new one.

What about RESPA?

What about it? 😂 The DUAL Commissions program doesn’t change anything about RESPA. It will keep right on RESPA-ing. As a DUAL Commissions Agent, you are considered a dual-capacity employee. Section 8 of the RESPA code provides an exemption to dual-capacity employees. So even though it is still there, it has no effect on DUAL Commissions.

Is this ONLY for mortgage loans associated my RE transactions?

Certainly not! As a DUAL Commissions Agent, you are a full-fledged mortgage loan officer empowered to write mortgage loans for any purpose and in any state. This could be for 1st mortgages, 2nd or other subordinate mortgages, HELOCs, etc. These could be for purchases, refinances (Rate and Term or Cashout), debt consolidation...anything!

Would I work with the same team for all of my loans?

Yes. There is no round-robin pool of Loan Partners or Loan Officer Assistants. You will work with the same awesome team on all of your loans unless and until we all decide that some change needs to be made that will somehow improve the operation.

What if I get stuck with a loan partner who is a jerk?

Let us know and we’ll assign someone else to you (who is not a jerk). 🙂👍

How much does it cost to become a Dual Commissions Agent?

Nada. Zip. Zilch. Well actually there are some nominal costs but the bank pays those on your behalf so there are no out of pocket expenses for you to get set up.

How long does it take to get setup?

That’s largely up to you. If you “get down on it”, you CAN be set up in as little a couple of weeks.

How can I keep tabs on my files?

So, right now if you want an update, you have to call your Loan Officer and ask what’s up. They can give you some general info, (should be CTC on Friday, etc), but not a lot of specifics. As a DC Agent, you ARE the Loan Officer of record with complete transparency to the file. You’ll just open your Simple Nexus app wherever you are and have full access to all file information. If you have further questions, just call or text your loan partner.

If I’m a Broker/Owner, will I be able to do loans for other Agents in my office and get paid on those?

Of course, you will be the bank employee and the loan officer of record for those loans and therefore the person getting paid. Whether you then pay them and how much is between you and them. Some Broker/Owners use this as an additional recruitment benefit (For further clarification, please review the answer to #13.)

Will I be able to do loans for other outside RE Agents’ deals and get paid on those too?

Yep. (For further clarification, please review the answer to #19. 😂)

So I really wouldn’t have to take any individual licensing class, pass a test or pay a licensing fee??

Nope.

Do the normal CE requirements apply to this program?

No. There is no “outside” continuing education required. The bank does have its own internal workshops and training. There are normally a couple of hours of video to view each quarter on things like fraud protection, anti-phishing, ECOA, Fair Housing, etc. There is no fee for this internal training.

If this is so great, why isn’t every Agent doing it?

We’re working on that. 😂 The fact is that we’ve only had this program available to talk about since early in 2024. To our knowledge, this is the first program of it’s kind that DOES NOT require the RE Agent to get a state lending license. We’re getting the word out as quickly as we can. There are also those who didn’t get the HUD memo from December 2022 and are still living under the conflict of interest delusion. Whichever. As they say, “You can lead a horse to water....”

So...you’re telling me that I can earn a .5% commission on the mortgage loans associated with my (or anyone else’s) RE transactions, without getting my own state license, without learning the loan production process, it’s fully compliant with SAFE Act, NMLS, RESPA and HUD so there is no conflict of interest, my job description doesn’t change, I can still use my current lending arrangement if it’s better for my client, AND the bank will even pay the cost of getting me set up??? 🤔

Yep. 👍🙂🎯

How is this different from other programs that license Realtors to do mortgages?

That’s a great question and part of the answer is actually in the question. Other programs typically license the Agent. That requires taking the 20 hour course pluswhatever specific state hours are required, passing the class, passing the state exam, and then actually getting the license which covers just that state. With thisprogram, you don’t do any of that because you’re under the bank’s license AND you can do loans in ALL 50 STATES.

50 Basis points doesn’t seem like much. Isn’t that a little low?

Really? How much are you earning on mortgages now? 😂 Consider this. After averaging compensation tiers, this is about what most of the big banks pay their LOs for doing all the work on the file. Here, your concierge team is doing the work on the file (after the app) and you’re getting about the same amount.

I always give out three LOs name so I don’t appear to be directing the client?

No problem. You can certainly be one of the three names. When they learn you can help them with their loan, most people will want more information.

Ok. I’ll bite. What’s the downside?

We’ve designed this program so that the only downside is NOT doing it. Think about it. What’s worst that can happen if you do this? You decide for some reason that you like your current arrangement better and just go back to it? Now, what’s the best that can happen? It is what we say it is and you’re now collecting potentially tens of thousand in additional revenue (depending on your production) that had been going to someone else from business that YOU generated.

What is the process to get started?

Easy. Just go to www.StartDUALCommissions.com and complete the application/survey there. That will give us your contact info and tell us a bit about your business, your volume, etc. You’ll upload your resume if you have one. If not, you’ll just enter where you’ve had your license the last 2 years or since you’ve been in the biz if less than that. Once that is submitted, you will receive an offer letter, normally in 24-48 hours. Once that has been E-Signed, our bank’s HR will reach out and help you get onboarded. 🎯If you need help, our team are there to help you move through the process smoothly and complete your onboarding as quickly and painlessly as possible.